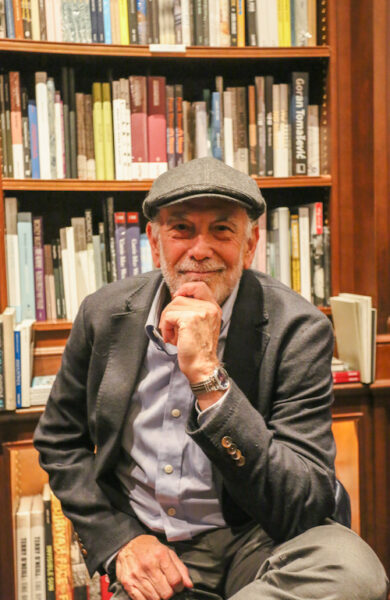

A Note from Peter Neuwirth: What is an actuary?

That’s the question I have been asked for more than 40 years.

I am Pete Neuwirth, and I love the work I do. So I wanted to go beyond answering that question to answer another: “How does an actuary think, and why does it matter?”

In my first book: “What’s Your Future Worth,” I provide what I believe is an accessible, step-by-step guide to using the powerful concept of Present Value—which allows readers to determine the value today of something that might happen in the future—to evaluate all of the outcomes that might arise from choosing one path as opposed to another.

My next book: This one takes this exploration to a new level. Entitled “Money Mountaineering,” I explore the world of money and provide views on its nature and the challenges we all face as we try to survive, even thrive, in this complex, uncertain, noisy, and sometimes irrational wilderness. It is designed to help readers understand what kind of advice they truly need—to gain a better understanding of the financial world they must live in and what they must do to make their way through it.

In actuarial circles: I am proud to say that I have a reputation among my peers as being a creative, knowledgeable, and experienced actuary with a penchant for both problem solving and thinking “outside of the box.” I also pride myself on being a storyteller who believes that the story from the actuarial perspective needs to be told. I am a frequent speaker at professional conferences and have been quoted in the mainstream and industry press on actuarial matters. I am also a Fellow of the Society of Actuaries and a Fellow of the Conference of Consulting Actuaries.

In actuarial circles: I am proud to say that I have a reputation among my peers as being a creative, knowledgeable, and experienced actuary with a penchant for both problem solving and thinking “outside of the box.” I also pride myself on being a storyteller who believes that the story from the actuarial perspective needs to be told. I am a frequent speaker at professional conferences and have been quoted in the mainstream and industry press on actuarial matters. I am also a Fellow of the Society of Actuaries and a Fellow of the Conference of Consulting Actuaries.

Experience: I have consulted with dozens of the world’s largest corporations about the retirement plans they sponsor, which has provided me with a deep practical understanding of three fundamental concepts (time, risk, money) that shape our world. Many of those insights are shared in my books, as well as the essays you’ll find on this website.

At home: I am a happy and proud resident of Santa Rosa, CA. When my house burnt down several years ago, I was inspired to write essays about the experience and pen stories about the pandemic and other life lessons. Click here to read more about that experience and how it inspired me and my colleagues to create a new company — Peter Neuwirth & Associates, a company that is a guide for those going through a Silver Divorce.

At home: I am a happy and proud resident of Santa Rosa, CA. When my house burnt down several years ago, I was inspired to write essays about the experience and pen stories about the pandemic and other life lessons. Click here to read more about that experience and how it inspired me and my colleagues to create a new company — Peter Neuwirth & Associates, a company that is a guide for those going through a Silver Divorce.

You are invited: Please peruse my website, check out my speaking engagements, and contact me if I or my partners can speak at your next event or on your podcast or video show. I look forward to talking with you soon!