Season 1: Episode 4 of Silver Divorce spotlights Lili Vasileff to help us create a Silver Divorce roadmap

February 2024: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — Please tune in for this month’s episode of Silver Divorce, where for […]

Read More

Season 2: Episode 5 of Money Mountaineering with Peter Neuwirth features an interview with Freedom Writer Foundation founder, award-winning educator, and bestselling author Erin Gruwell

A Note from Actuary and Author Peter Neuwirth, FSA, FCA, host, “Money Mountaineering: The Sharing Economy” — I invite you to tune in for this week’s episode […]

Read More

Season 2: Episode 4 of Money Mountaineering with Peter Neuwirth features Michael Edesess, author of “The Big Investment Lie,” and “The 3 Simple Rules of Investing”

A Note from Actuary and Author Peter Neuwirth, FSA, FCA, host, “Money Mountaineering: The Sharing Economy” — I invite you to tune in for this week’s episode […]

Read More

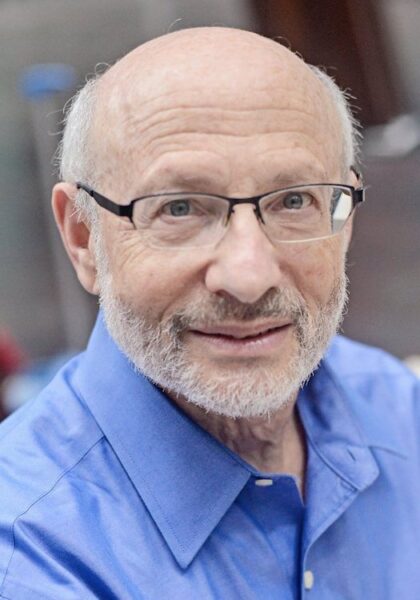

Season 1: Episode 3 of Silver Divorce features highly respected forensic accountant James Schaefer

December 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — I invite you to tune in for this month’s episode of my podcast and […]

Read More

Season 1: Episode 2 of Peter Neuwirth’s new show, Silver Divorce: How to Simplify a Painful Process shines a light on Divorce Planner Brooke Benson who teaches us about “Mortgages and Divorce”

November 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — I invite you to tune in for this month’s episode of my podcast and […]

Read More

Season 2: Episode 3 of Money Mountaineering with Peter Neuwirth features critical thinking expert Richard Conn, Jr., author of “The Earthbound Parent”

November 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA, host, “Money Mountaineering: The Sharing Economy” — I invite you to tune in for this […]

Read More

Season 1: Episode 1 of Peter Neuwirth’s new show, “Silver Divorce: How to Simplify a Painful Process” features Certified Divorce Financial Analyst, CFP® professional Marguerita Cheng

October 1, 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — I invite you to tune in for this month’s episode of my podcast […]

Read More

VoiceAmerica: “Asset Division in Silver Divorce: What You Need to Know,” hosted by Brooke Benson

About this episode: Getting divorced while you are still in your earning years is one thing … ending your marriage in retirement can add financial […]

Read More

Season 2: Episode 2 of Money Mountaineering with Peter Neuwirth features Rebekah Wright, Bookstore Manager for Barnes and Noble in Santa Rosa, CA

September 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — I invite you to tune in for this week’s episode of my podcast and […]

Read More

Introducing the Silver Divorce Podcast Show: Actuary Peter Neuwirth & Associates simplify a painful process

August 2023: A Note from Peter Neuwirth — Silver Divorce Consulting and the lessons I have learned from a California wildfire Having my house burn […]

Read More

Season 2: Episode 1 of Money Mountaineering with Peter Neuwirth features Steve Shirrell, owner emeritus of Santa Rosa’s Stanroy Music Center

August 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — I invite you to tune in for Season 2 of my podcast and video […]

Read More

July 2023: Episode 10 of Money Mountaineering features our interview with Russ Proctor Managing Director of Pensions at Pacific Life

July 2023: A Note from Actuary and Author Peter Neuwirth, FSA, FCA — I invite you to tune in for this week’s episode of my podcast and […]

Read More